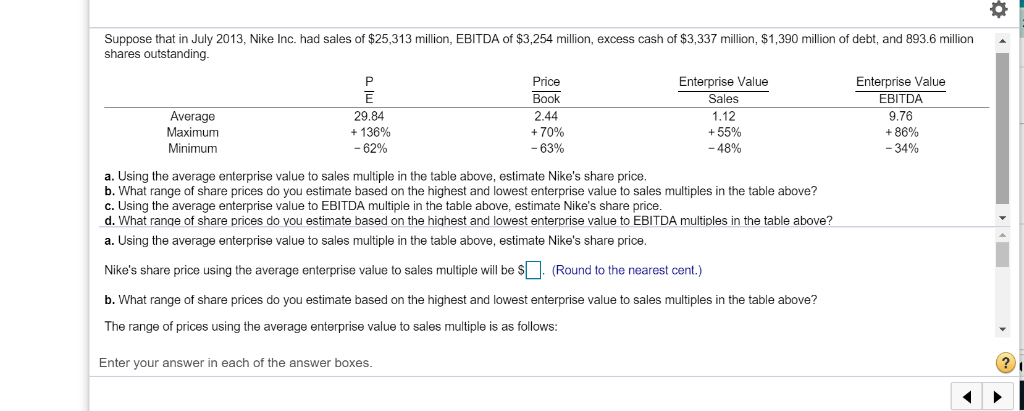

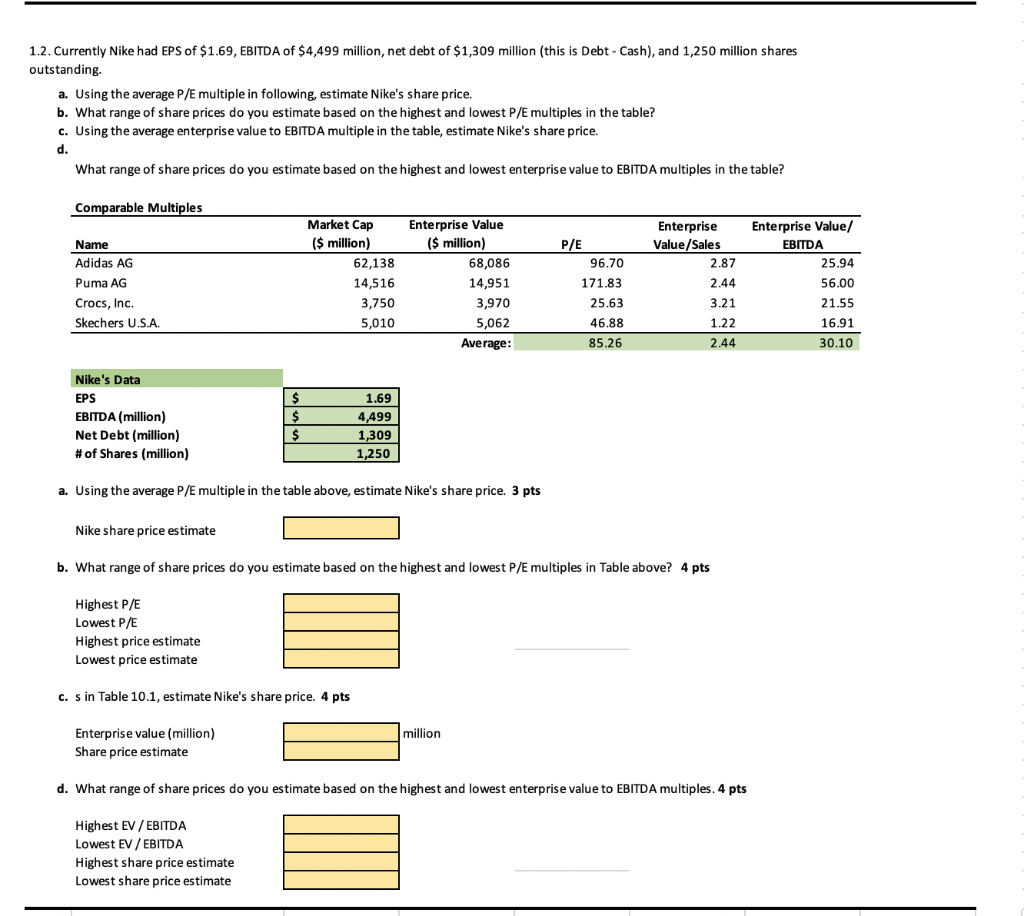

Nike Common Stock Valuation - May 24, 2010 Nike Common Stock Valuation As of May 24, 2010 By Valentyn Khokhlov, MBA. - ppt download

11Graphs on Twitter: "2/ Best managed companies among the most reputable by EBITDA RoIC: 1. 🇺🇸 MICROSOFT $MSFT: 155.4% 2. 🇺🇸 NIKE $NKE: 65.8% 3. 🇺🇸 GOOGLE $GOOGL: 64.4% 4. 🇯🇵 NINTENDO $NTDOY: 57.6% 5. 🇯🇵 SONY $SNE: 47.2% https://t.co ...